Introduction

In the fast-evolving digital landscape, Fortune 500 companies are increasingly turning to private blockchain solutions to enhance security, scalability, and operational efficiency. FlexLab has emerged as the preferred choice for these enterprises, offering cutting-edge blockchain technology tailored to the unique needs of large-scale organizations.

The Growing Demand for Private Blockchain Solutions

- Data Security & Privacy Compliance: Enterprises require secure, permissioned blockchain networks to protect sensitive data and ensure regulatory compliance with standards such as GDPR and HIPAA.

- Operational Efficiency & Cost Reduction: Private blockchains eliminate intermediaries, reducing transaction costs and improving efficiency in areas like supply chain management, payments, and contract execution.

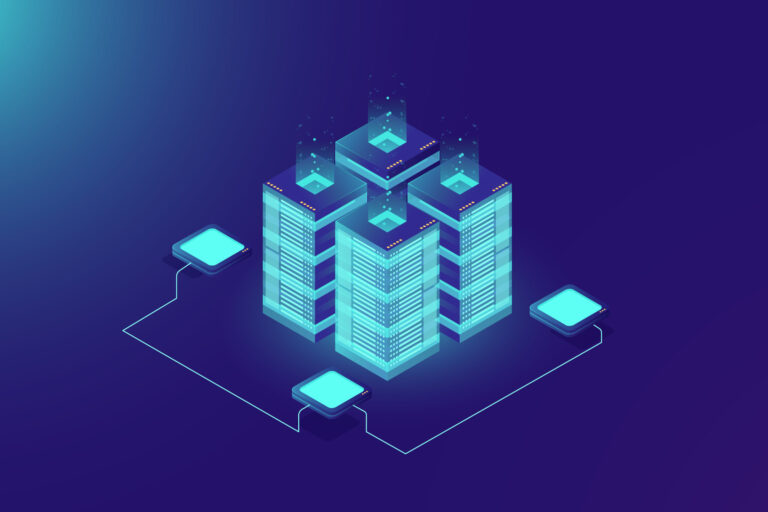

- Customizable & Scalable Infrastructure: Fortune 500 companies need flexible blockchain architectures that can integrate seamlessly with existing enterprise systems and scale according to business growth.

Why Fortune 500 Companies Choose FlexLab

- Enterprise-Grade Security & Compliance: Advanced Encryption & Zero-Knowledge Proofs to safeguard sensitive data. Built-in Compliance Frameworks ensuring adherence to global regulations.

- Seamless Integration with Legacy Systems: API-based architecture allows easy integration with ERP, CRM, and cloud infrastructures. Supports interoperability with Ethereum, Hyperledger, and Corda.

- High Performance & Scalability: Optimized consensus mechanisms for faster transaction processing. Modular architecture enabling businesses to customize blockchain functionalities.

- Cost-Effective & Efficient Smart Contracts: FlexLab’s low-code smart contract solutions reduce development time and deployment costs. Built-in automated auditing tools enhance contract security.

- Trusted by Leading Enterprises: Case Study: Fortune 500 Financial Institution implemented a private blockchain network for secure cross-border transactions, reducing processing time by 60%. Case Study: Global Supply Chain Leader deployed a blockchain-based track-and-trace system, improving transparency and reducing fraud by 40%.

Future of Private Blockchain Solutions with FlexLab

As enterprises continue adopting blockchain technology, FlexLab remains committed to innovation in:

- AI-driven security enhancements for blockchain networks.

- Interoperable multi-chain solutions for cross-industry applications.

- Decentralized identity frameworks for secure and verifiable user authentication.

Conclusion

Fortune 500 companies trust FlexLab for private blockchain solutions because of its unparalleled security, seamless integration, and scalable infrastructure. By leveraging FlexLab’s expertise, enterprises can future-proof their operations and unlock new efficiencies in the digital economy.

Discover how FlexLab can transform your enterprise with private blockchain solutions. Visit FlexLab.io today.